EUROPEAN COMMISSION Brussels, 30.11.2017 SWD(2017) 428 final COMMISSION STAFF WORKING DOCUMENT IMPACT ASSESSMENT Accompanying t

CASE REPORT: an 8 % increase in VAT revenue due to increased compliance, and a 6 % increase due to favourable economic climate - CASE - Center for Social and Economic Research

Annual Activity Report 2017 of the EPP Group in the European Parliament by EPP Group in the European Parliament - issuu

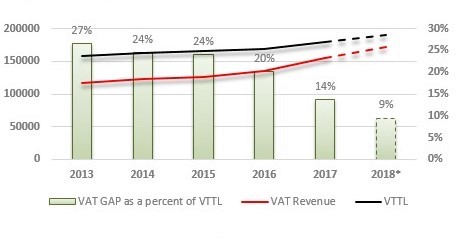

Study and Reports on the VAT Gap in the EU-28 Member States: 2017 Final Report - CASE - Center for Social and Economic Research

Eugen Jurzyca on Twitter: "Before further #harmonisation of VAT rules it would be worth analysing the effectiveness of national antifraud VAT measures and exchange of best practices to know why some Member