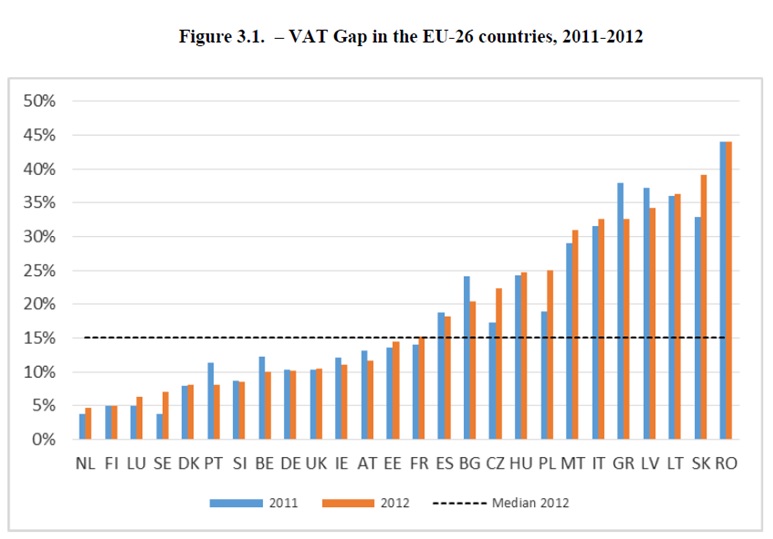

2012 Update Report to the Study to quantify and analyse the VAT Gap in the EU-27 Member States - CASE - Center for Social and Economic Research

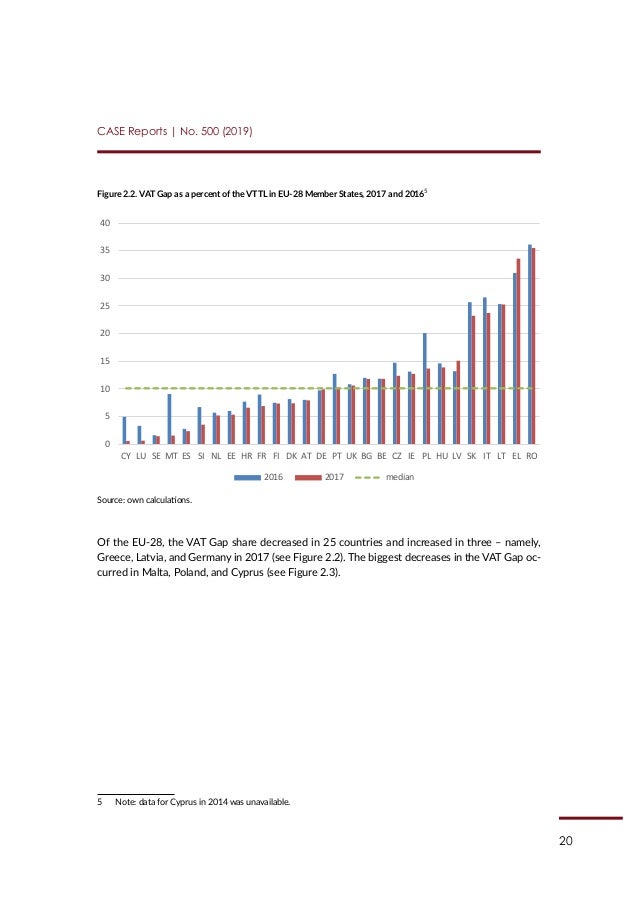

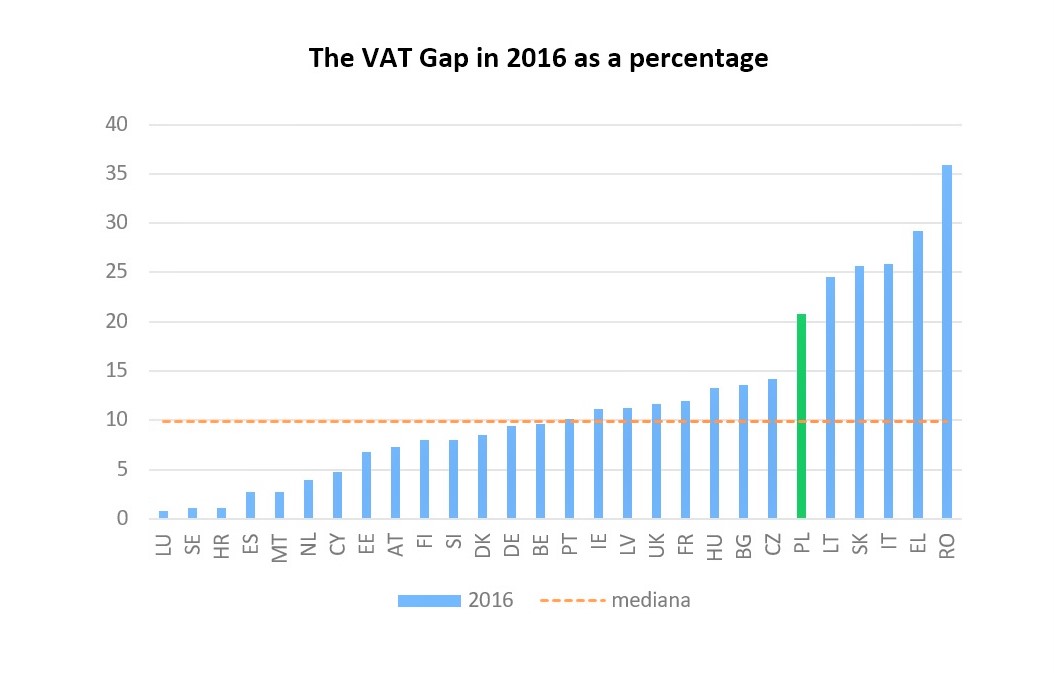

EUR 147.1 billion in VAT revenues was lost in 2016 in the EU - CASE - Center for Social and Economic Research

Time-varying VAT gap and persistent VAT gap in the western group of EU... | Download Scientific Diagram

The Revenue Administration—Gap Analysis Program: Model and Methodology for Value-Added Tax Gap Estimation

6: VAT gap as a share of potential VAT liability hypothesis with and... | Download Scientific Diagram

Study to quantify and analyse the VAT Gap in the EU-27 Member States - CASE - Center for Social and Economic Research