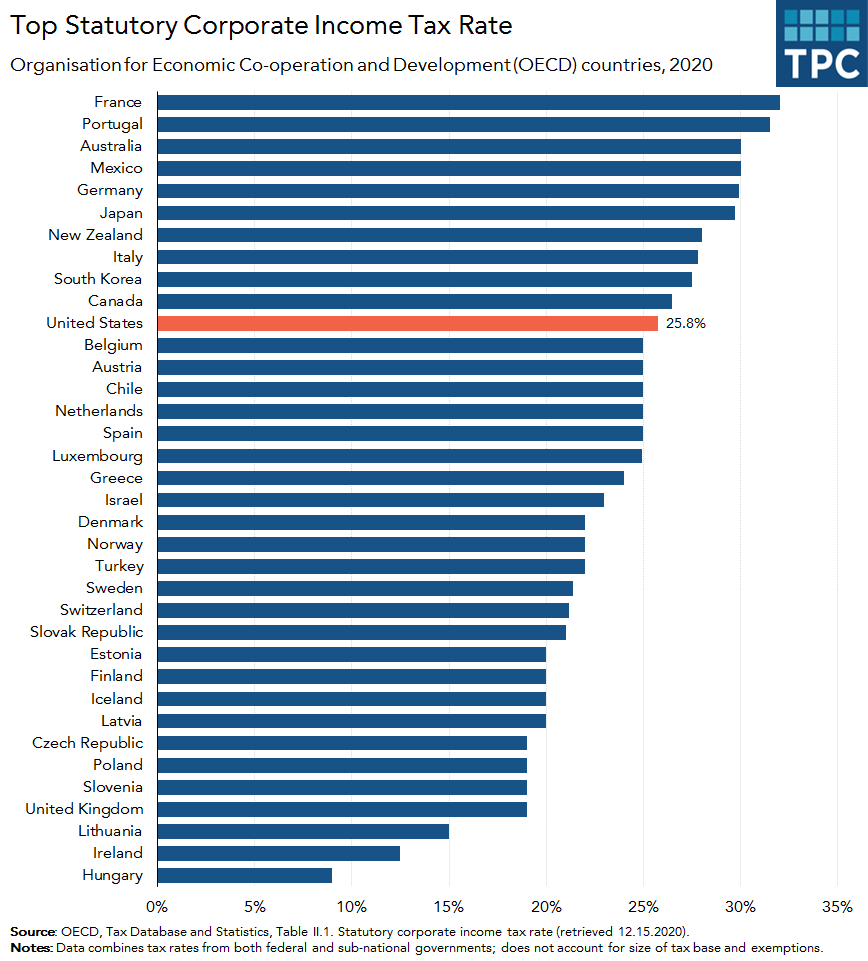

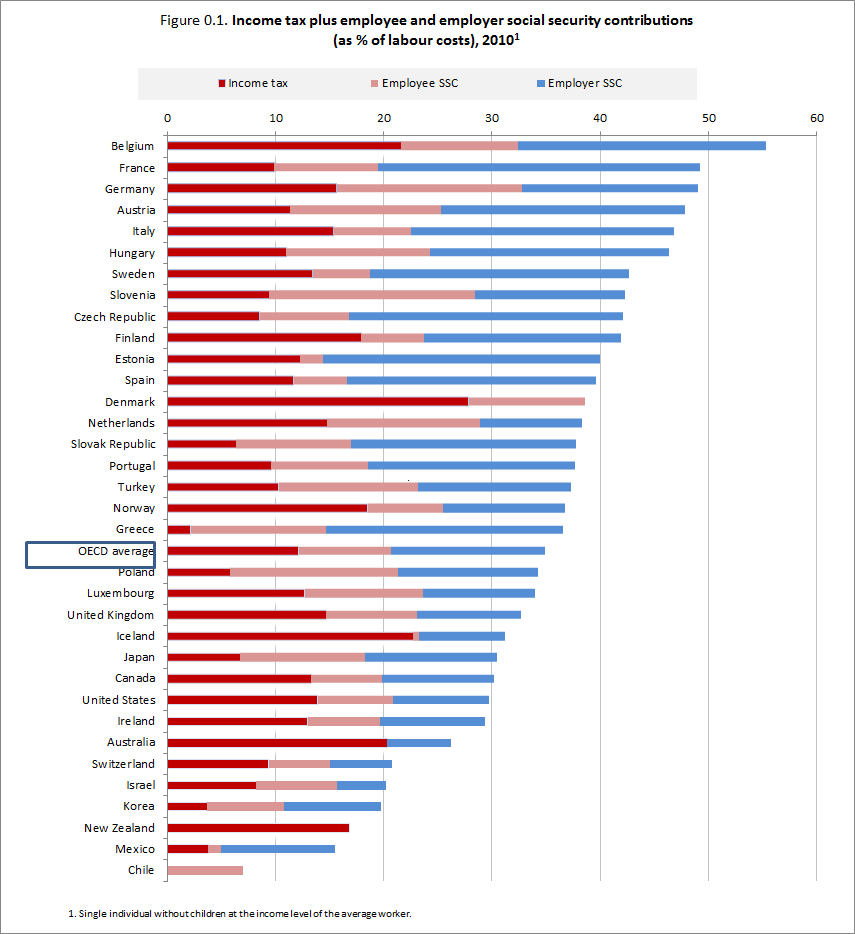

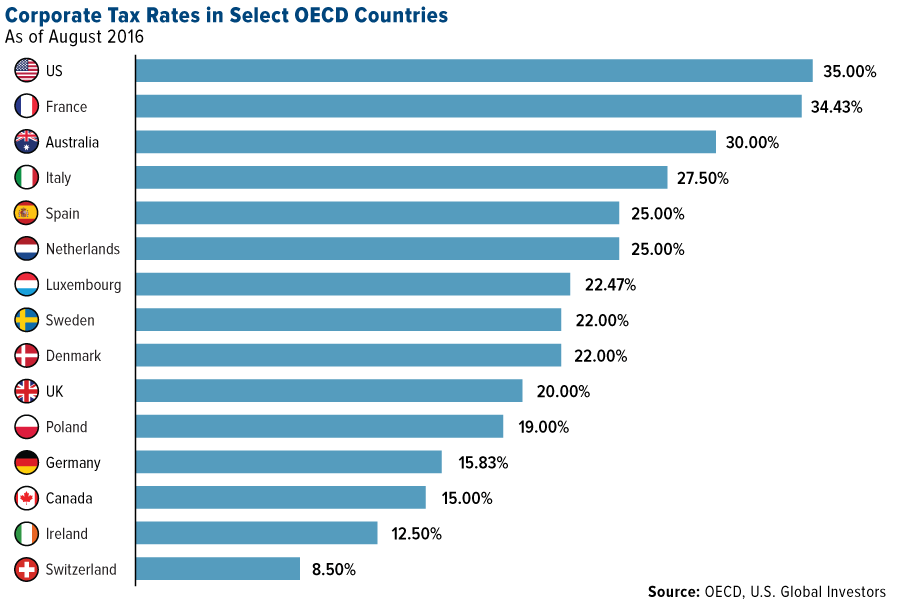

Effective marginal tax rates on corporate income. OECD. 2012 Source:... | Download Scientific Diagram

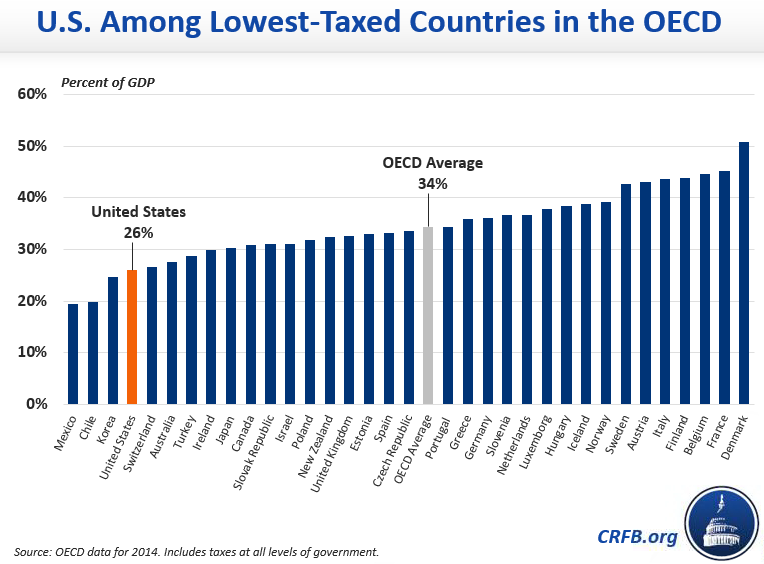

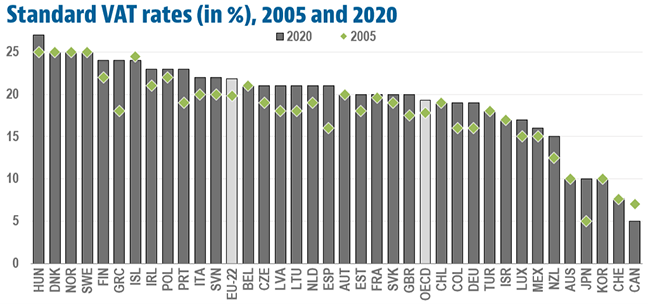

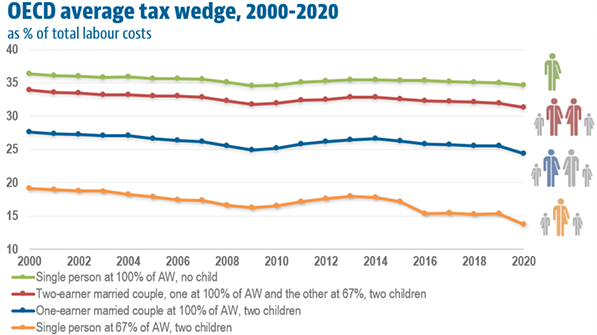

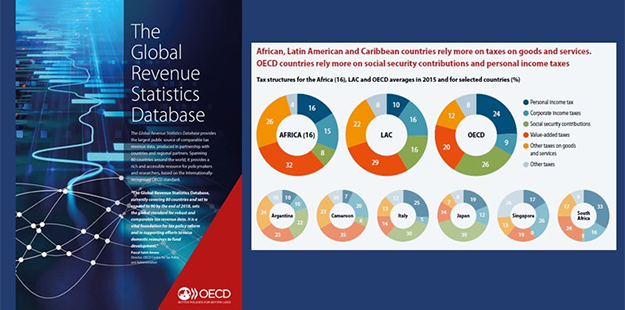

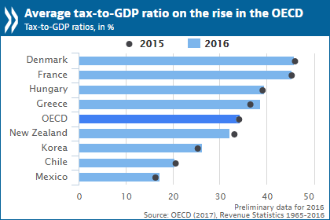

Social security contributions and consumption taxes give way to personal income taxes, as corporate income taxes fail to recover - OECD

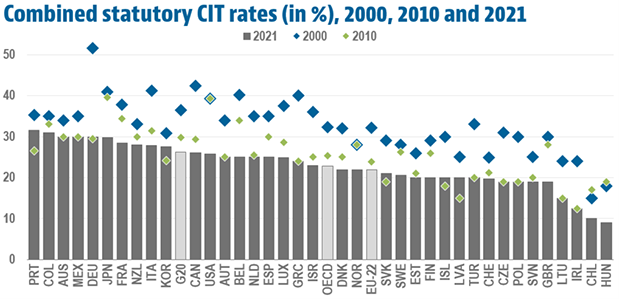

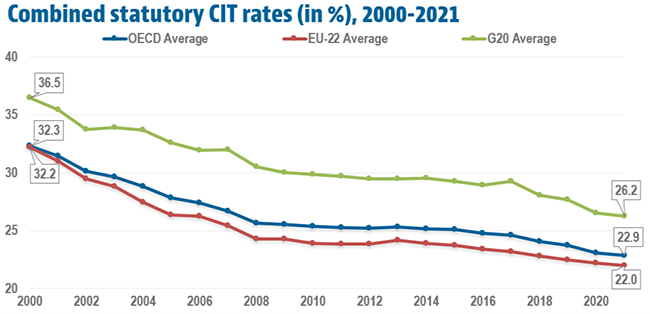

Corporate income tax rates. OECD average (unweighted) and the Nordic... | Download Scientific Diagram